There are several ways to earn passive income from real estate. These include renting property, house flipping, REITs and peer-to-peer loans. This article will explain the basics and how to make passive income with real estate. These tips will help you make your investment successful if you don't have the funds. Read on to learn more about the possibilities of passive income from real estate. It is easy to reach your real estate goals.

Properties to rent

Renting out properties is a good way to make passive income from real property. It is important to choose the right tenants. But, it is also important to be careful to not cause any problems. Additionally to carefully screening potential tenants, it is also important to be on the lookout for vacant homes. If you fail to properly screen potential tenants, you could end up losing your money, going through a lengthy eviction process, and even facing a lawsuit.

Flipping houses

Many sources can provide passive income through house flipping. You can flip fixer-uppers, foreclosed properties, or rental properties to make income. These properties can be rented out as turnkey rentals, or fully renovated homes that are fully rented. The property can be rented and managed by the new owners. House flipping can be a profitable way to generate passive income. Technology makes it easy to streamline the process.

Peer-to-peer lending

Passive income options are many when it comes investing in real property. Single-family houses, for instance, can be handled easily, while apartment buildings require more involvement. Other than paying the rent, you will also have to manage the property, pay the insurance and monitor the maintenance. Storage facility investments can also be a passive source of income. Demand for these properties is high in virtually every populated region in the United States, and you can generate passive income by leasing out your spaces to tenants.

REITs

Passive income from REITs is an excellent way to diversify your portfolios. These securities have low investment costs, with a unit costing as little as $500. However, if you are looking to earn income from real estate, these REITs must give at least 90% of their taxable income back to shareholders. This leaves less money to reinvest. This article will discuss why passive income from real-estate REITs is a great option.

Storage facilities

Self-service storage units can provide passive income that you can use to generate passive income all year. Some areas, like Quebec and Canada, have seasonal needs, but there is always a demand for more space. Depending on where you live, you might see a variety of customers year-round. Below are some revenue-generating options for storage facilities. Some of these ideas require a lot of work and time, but will provide you with a steady source of extra income.

FAQ

How much does it take to replace windows?

Replacement windows can cost anywhere from $1,500 to $3,000. The cost to replace all your windows depends on their size, style and brand.

What are the advantages of a fixed rate mortgage?

Fixed-rate mortgages lock you in to the same interest rate for the entire term of your loan. This will ensure that there are no rising interest rates. Fixed-rate loans come with lower payments as they are locked in for a specified term.

How many times can my mortgage be refinanced?

This is dependent on whether the mortgage broker or another lender you use to refinance. Refinances are usually allowed once every five years in both cases.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

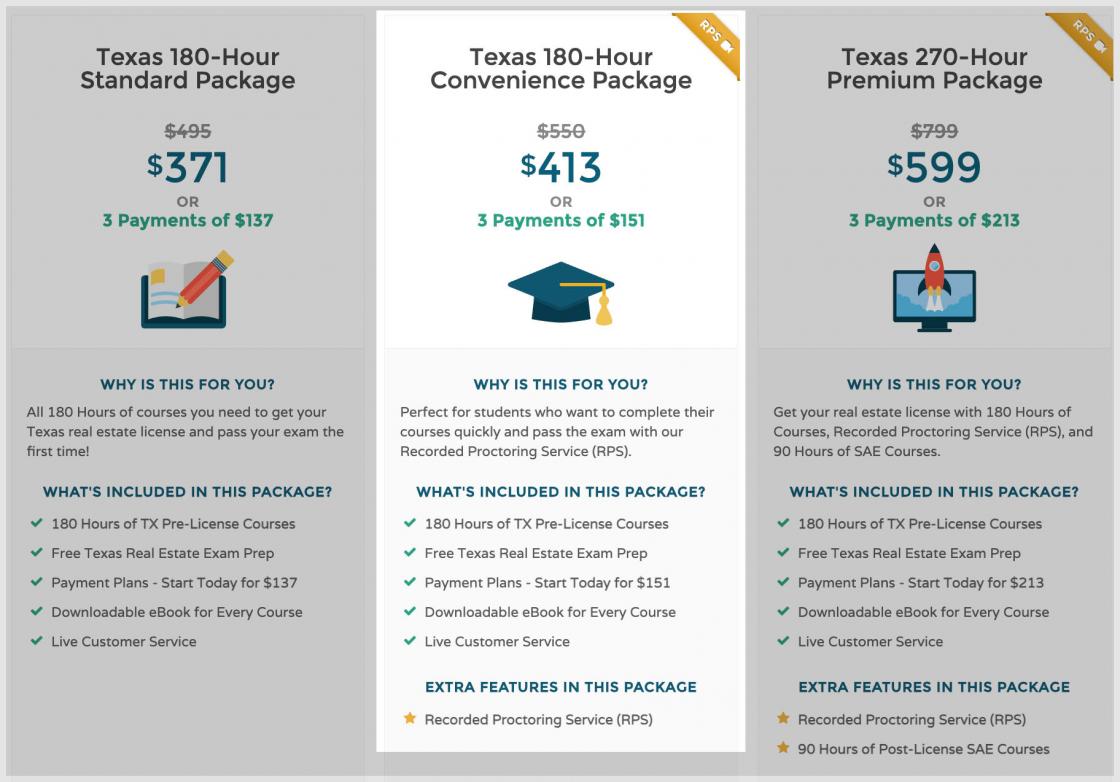

How to be a real-estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next you must pass a qualifying exam to test your knowledge. This involves studying for at least 2 hours per day over a period of 3 months.

You are now ready to take your final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

If you pass all these exams, then you are now qualified to start working as a real estate agent!