First, you need to get a California realty license before you can work in realty. There are a few things you need to do, including sending in a fingerprint sheet to the Bureau of Real Estate. The next step is to find a school offering real estate training.

Courses required to get a real estate license in California

You must first complete the pre-license classes to get a California realty license. These courses should only be taken by accredited colleges or universities. The Department of Real Estate maintains an accreditation list. Online classes are also available. However, be aware of your time and budget requirements.

The courses you take must be approved by the state's Department of Real Estate. AceableAgent has been approved by the California Department of Real Estate as an online real estate school. These courses are regularly updated and often available at a discount rate. The course materials can be difficult to read, and students often report taking too much time to understand the information.

Exam pass rate

There are many ways to prepare for the real-estate license exam. The key to success is choosing the right program. Make sure that you enroll in a comprehensive program. You will also need to be able take quizzes and practice exams, as well as study material for your written exam. Some programs offer audio or video courses.

High pass rates are not uncommon in real estate schools. The CE Shop boasts a 91% pass rate. The CE Shop offers the most up-to date information. You may also find discounted courses. However, you should be aware that the course materials may be tedious to read. Many students find the course materials difficult to comprehend.

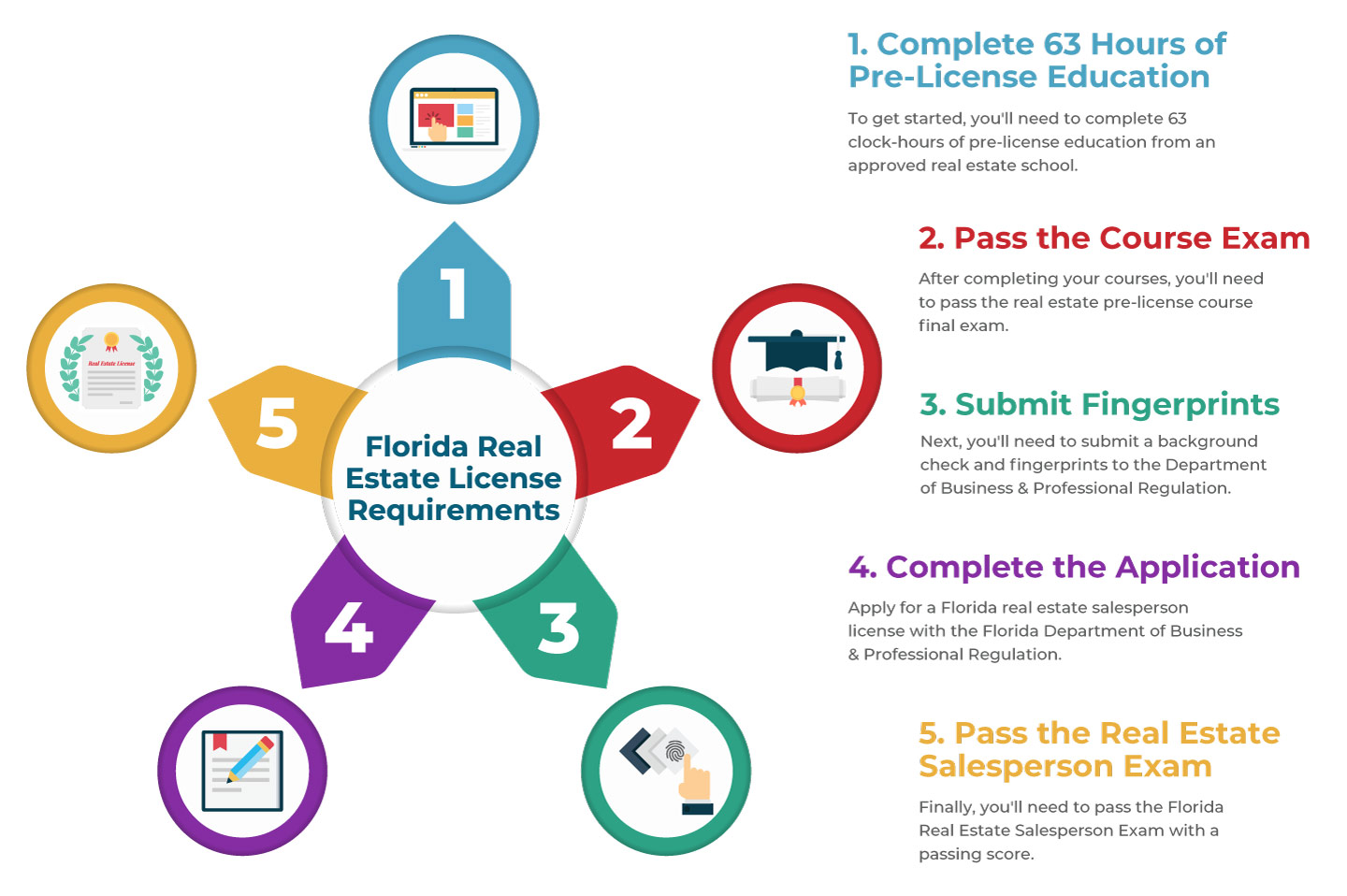

Pre-licensing requirements

The first step in obtaining a real estate license in California is completing a pre-licensing course. There are several online courses to choose from that will prepare you for the real estate exam. Good prep courses will provide you with additional study materials and real-world scenarios.

California requires that you take at least one pre-licensing course and complete 135 hours of related coursework. On the California Department of Real Estate’s website, you can see how many hours of training you need.

Requirements for school

In California, students must complete at least one year of education prior to obtaining a real estate license. The program must include at least two core courses that total 135 hours. Real Estate Principles is one of the core courses. This course covers ethics, real estate law, and ethics. The second course is about contracts, escrow and financing. Students must also complete a listing course.

Students must take the core courses and also complete a background check by completing a live scan to their criminal records. Refusal to disclose criminal records could result in a denial of licensure. The state exam is difficult. However, many schools offer extra resources for students in preparation for the exam.

FAQ

How do you calculate your interest rate?

Market conditions impact the rates of interest. The average interest rates for the last week were 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. Example: You finance $200,000 in 20 years, at 5% per month, and your interest rate is 0.05 x 20.1%. This equals ten bases points.

How can I fix my roof

Roofs can leak because of wear and tear, poor maintenance, or weather problems. For minor repairs and replacements, roofing contractors are available. Contact us for more information.

How much money do I need to save before buying a home?

It depends on how much time you intend to stay there. Start saving now if your goal is to remain there for at least five more years. But if you are planning to move after just two years, then you don't have to worry too much about it.

Can I buy my house without a down payment

Yes! Yes. These programs include FHA, VA loans or USDA loans as well conventional mortgages. For more information, visit our website.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to Purchase a Mobile Home

Mobile homes are houses constructed on wheels and towed behind a vehicle. Mobile homes were popularized by soldiers who had lost the home they loved during World War II. Today, mobile homes are also used by people who want to live out of town. These homes are available in many sizes and styles. Some are small, while others are large enough to hold several families. There are even some tiny ones designed just for pets!

There are two main types for mobile homes. The first type is produced in factories and assembled by workers piece by piece. This process takes place before delivery to the customer. You can also build your mobile home by yourself. Decide the size and features you require. Next, make sure you have all the necessary materials to build your home. The permits will be required to build your new house.

These are the three main things you need to consider when buying a mobile-home. You might want to consider a larger floor area if you don't have access to a garage. A larger living space is a good option if you plan to move in to your home immediately. You should also inspect the trailer. Problems later could arise if any part of your frame is damaged.

You need to determine your financial capabilities before purchasing a mobile residence. It's important to compare prices among various manufacturers and models. You should also consider the condition of the trailers. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

You can also rent a mobile home instead of purchasing one. You can test drive a particular model by renting it instead of buying one. Renting isn’t cheap. Renters generally pay $300 per calendar month.